Unbelievable Info About How To Apply For Working Tax Credit

Applying for the erc helps qualifying employers get substantial payroll tax credits that aim to encourage them to keep.

How to apply for working tax credit. Talk to our employee retention credit experts to determine if you are eligible for credit Employers may meet their business needs and claim a tax credit if they hire an individual who is in a wotc targeted group. If you are already claiming tax credits and you need to change your claim (for example you already get child tax credit and want to claim working tax credit), call hm revenue and customs.

Over 80% of businesses that apply qualify A business spends money, then makes an application for a tax credit. Check to see if you qualify.

Ad we take the confusion out of erc funding and specialize in working with small businesses. Payroll tax refund available now. Ad we take the confusion out of erc funding and specialize in working with small businesses.

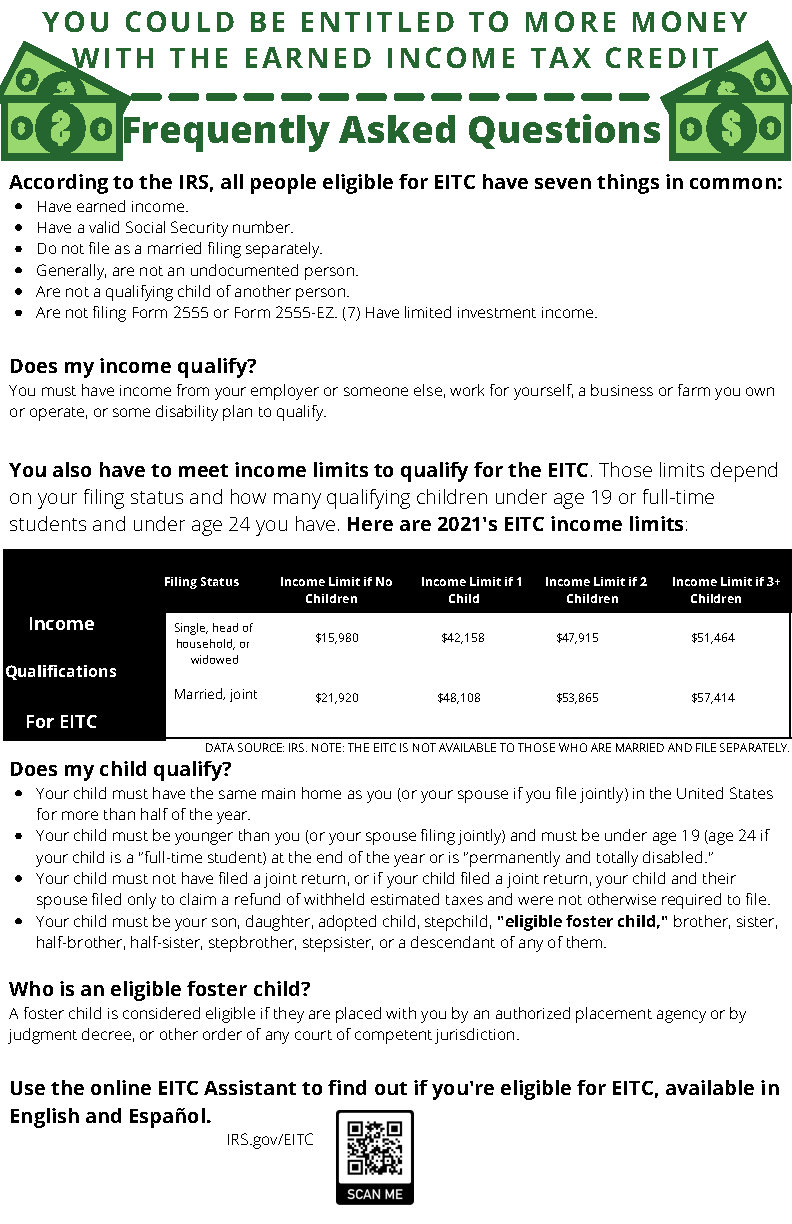

The alabama historic rehabilitation tax credit is a 25% refundable tax credit available for private homeowners and owners of commercial properties who substantially rehabilitate historic. Ad the irs is giving businesses $26k per employee. You must work a certain number of hours a week to qualify.

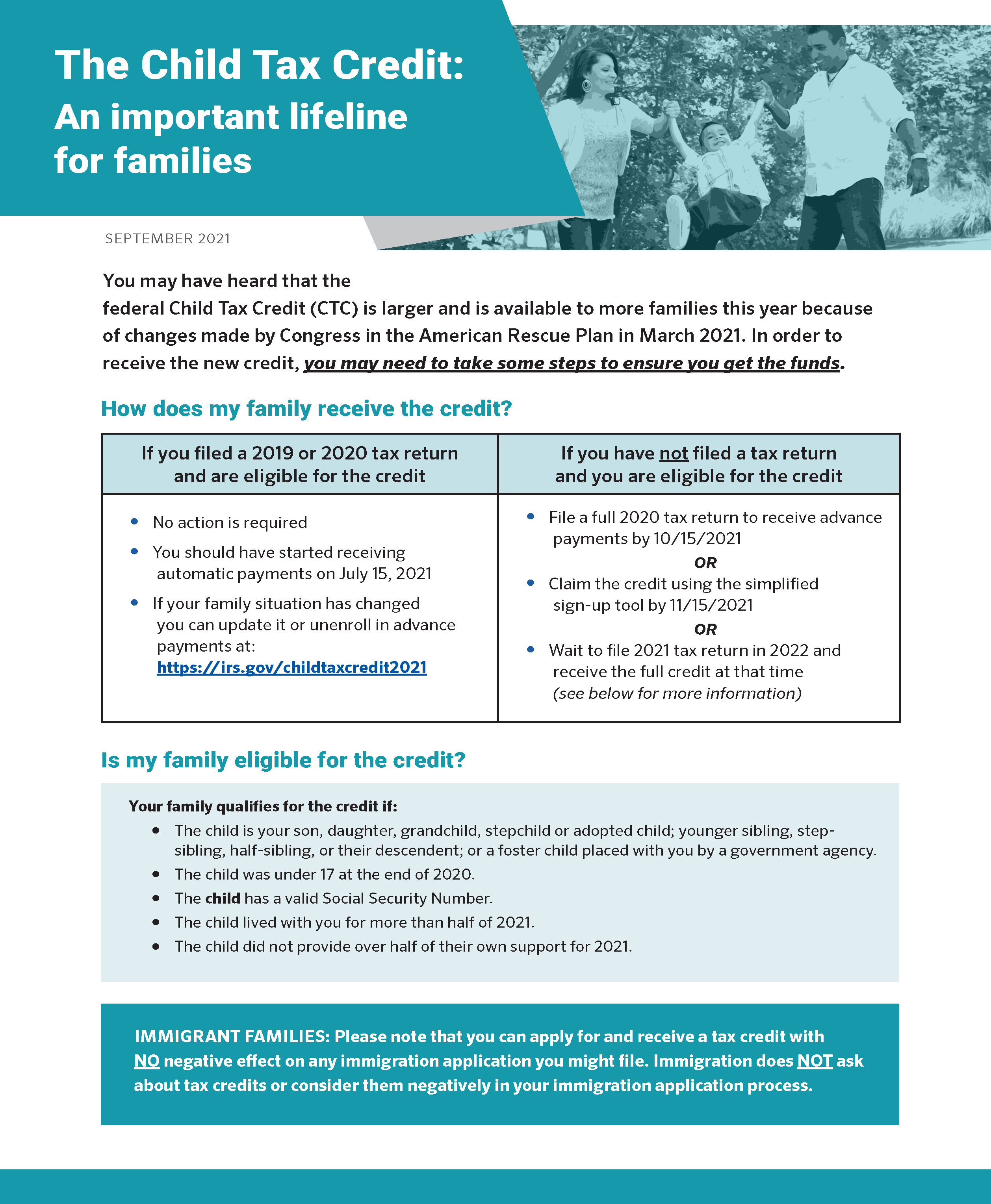

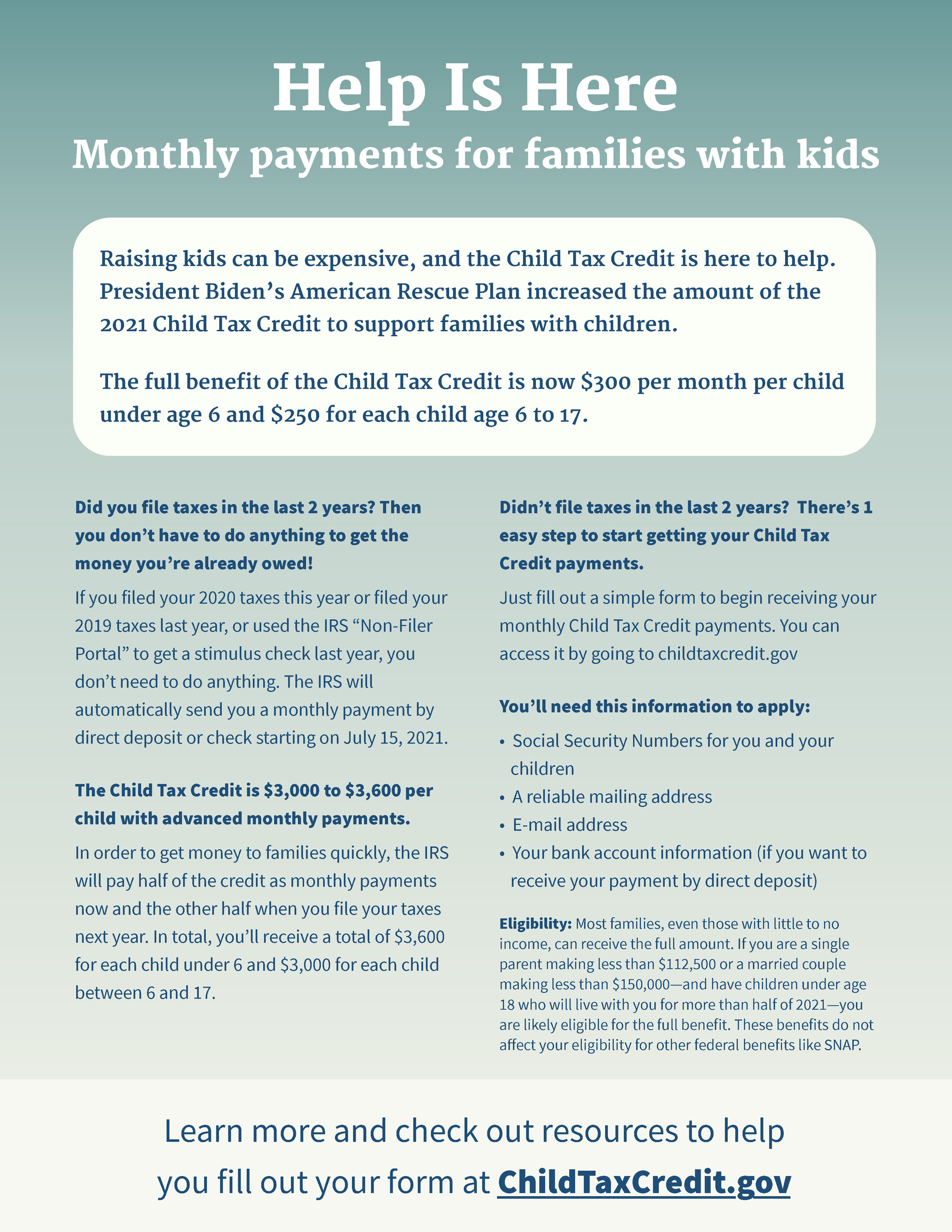

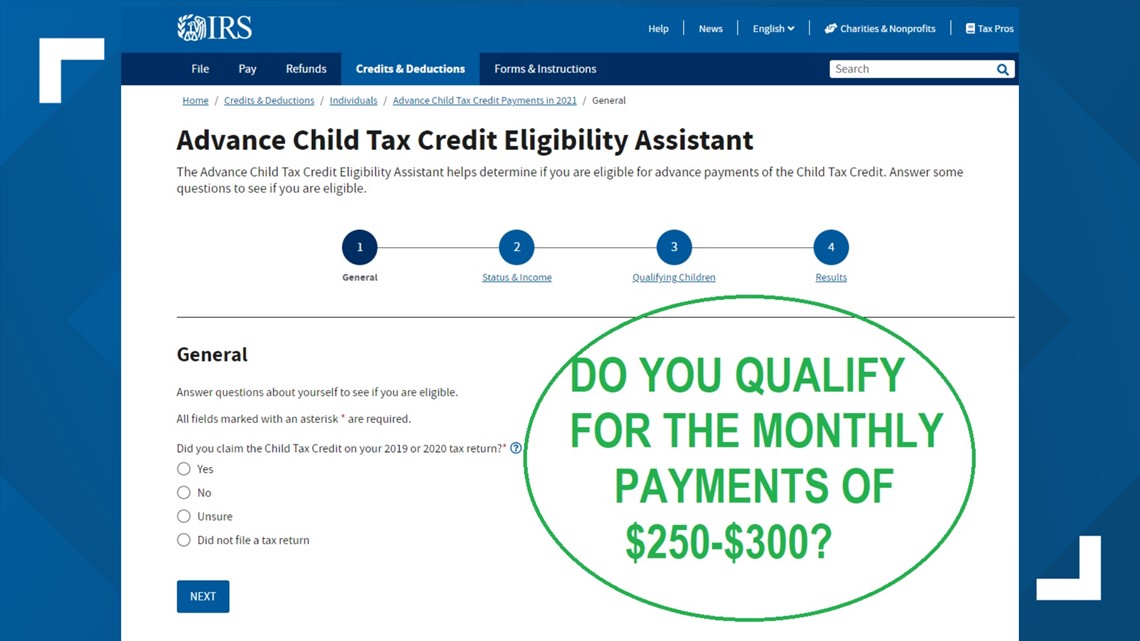

If you have a qualifying child, you must also file the schedule eic. Up to $26,000 per employee. The child tax credit in the american rescue plan provides the largest child tax credit.

Applications open in 2023 for the 2022 tax year and are accepted through december 31, 2023. Individuals and families are eligible for the working families tax credit if they meet all of the. Start your tax return today!

%20how%20to%20claim%20it%20for%20my%20business.png)

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)